2024 Irs 1040 Schedule 46 48 – The Internal Revenue Service (IRS) has released the tax refund schedule for the year 2024 used this form will now be required to use Form 1040 or Form 1040-SR. The IRS has made this change . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Irs 1040 Schedule 46 48

Source : www.thenation.com2024 LARGE PRINT CROSSWORD: 50 Crossword Puzzle Book For Adults

Source : www.amazon.comThe benefits of filing taxes before Tax Day CBS Pittsburgh

Source : www.cbsnews.com250 Seville Street, Jacksonville, NC 28546 | Compass

Source : www.compass.comUS National Weather Service Quad Cities Iowa/Illinois Dry with

Source : m.facebook.comAusaf Digital on X: “Two days remaining until Pakistan’s

Source : twitter.com2024 ELC BOYS Basketball Conference Q Custom Designs | Facebook

Source : m.facebook.comSpa moving and Delivery Atlanta Spa & Leisure

Source : atlantaspa.comMindy Solomon Gallery | Miami FL

Source : www.facebook.comTanner D on X: “Really says a lot when the nation’s largest radio

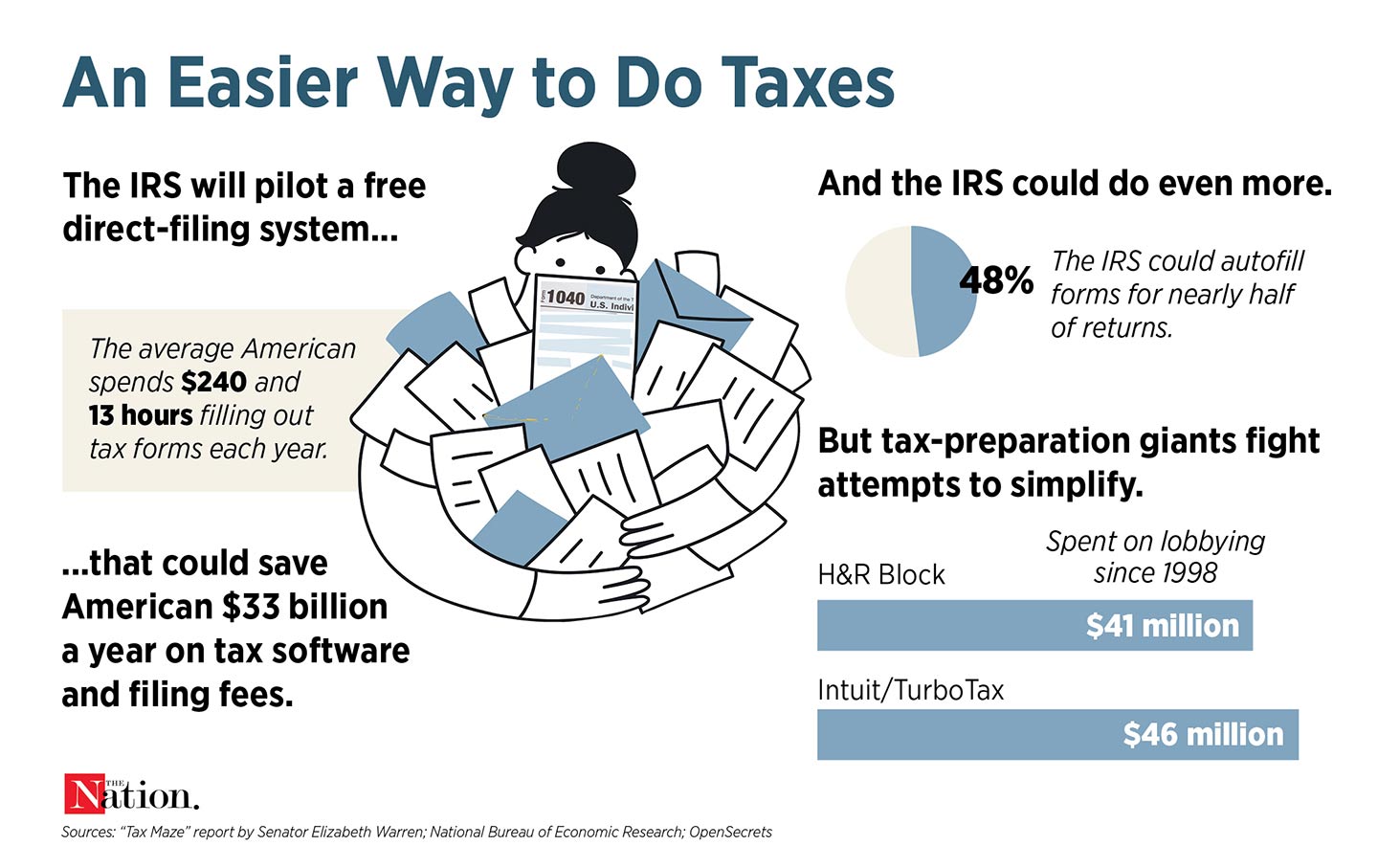

Source : twitter.com2024 Irs 1040 Schedule 46 48 There’s No Reason Filing Taxes Should Be So Hard | The Nation: Complete IRS 1040 Schedule C, “Profit Or Loss From Business.” On the Schedule C, you are required to enter your name, Social Security number, business name (if applicable), business address . This is in line with the history of how the IRS has handled this question. When it was introduced in 2019, the question was on Schedule 1 of Form 1040, but since many taxpayers do not complete .

]]>