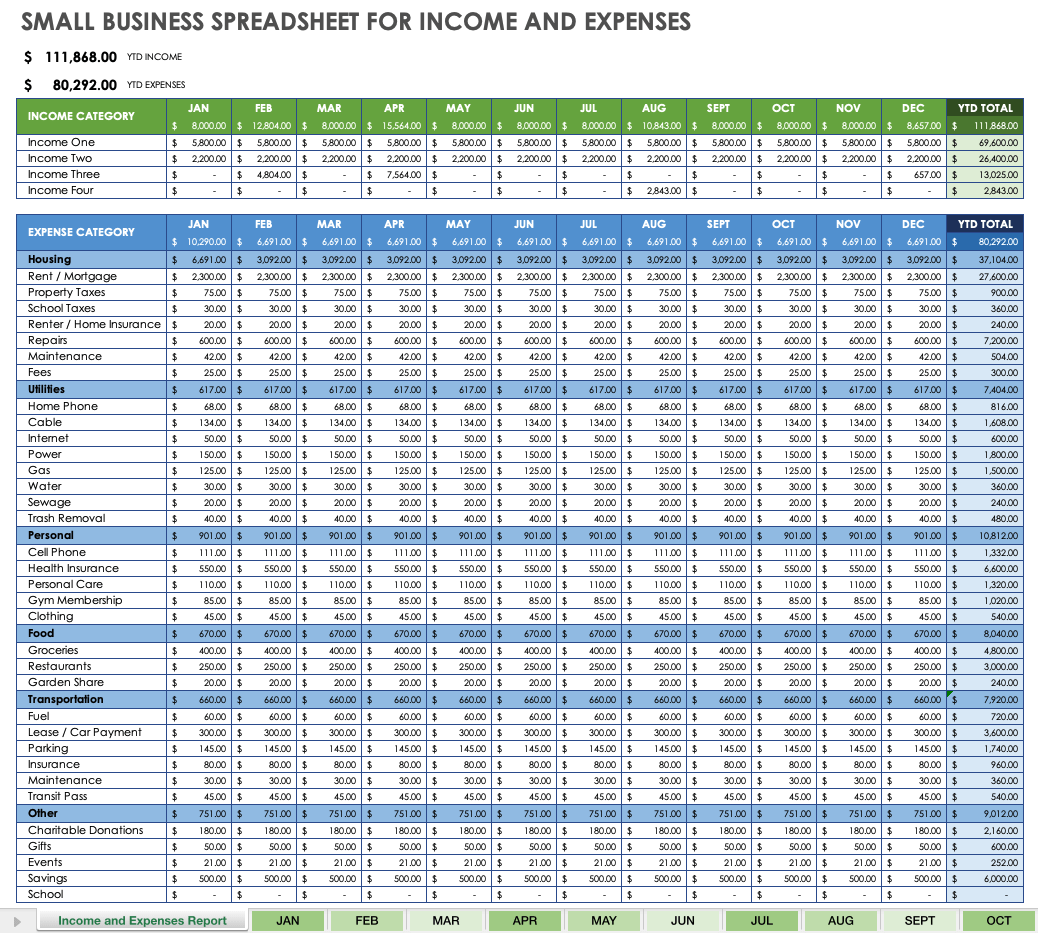

2024 Allowable Business Expenses Sheet – However, it may be allowable when reasonable circumstances (e.g. timing issues) occur and a business reason for the use of this option is clearly documented. Only expenses directly related to the . Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations. Whether you’re an entrepreneur or a small business .

2024 Allowable Business Expenses Sheet

Source : www.freshbooks.comFree Small Business Expense Report Templates | Smartsheet

Source : www.smartsheet.comFree Business Expense Tracking Spreadsheet (2024)

Source : www.betterwithbenji.comThe Ultimate List Of Google Sheets Budget Templates For 2023

Source : www.tillerhq.comUnited States Steel Corporation Reports Third Quarter 2023 Results

Source : www.businesswire.comFree Leave Tracker Excel [2024] Vacation Tracker

Source : vacationtracker.ioSmall Business Tax Deductions Cheat Sheet, Tax Deductions Item

Source : www.etsy.comEvent Listing Request Form Public Submission Event Calendar

Source : business.whittierchamber.comPDX 311 | Portland OR

Source : www.facebook.comUpcoming Ag & Natural Resource Programs and Events | Belmont

Source : belmont.osu.edu2024 Allowable Business Expenses Sheet 25 Small Business Tax Deductions To Know in 2024: Regardless of the funding source or business purpose, when allowable, expenditures for alcoholic beverages must be charged to object code 79050 (government unallowable charges) or 90290 (government . Business meals that exceed the meal allowance rate require an approved justification statement for up to 150% of the meal allowance and are allowable expenses to charge to State Funds. Meals that .

]]>